Support Your Masjid Urgent Appeal

Just Click & Pay your Donations

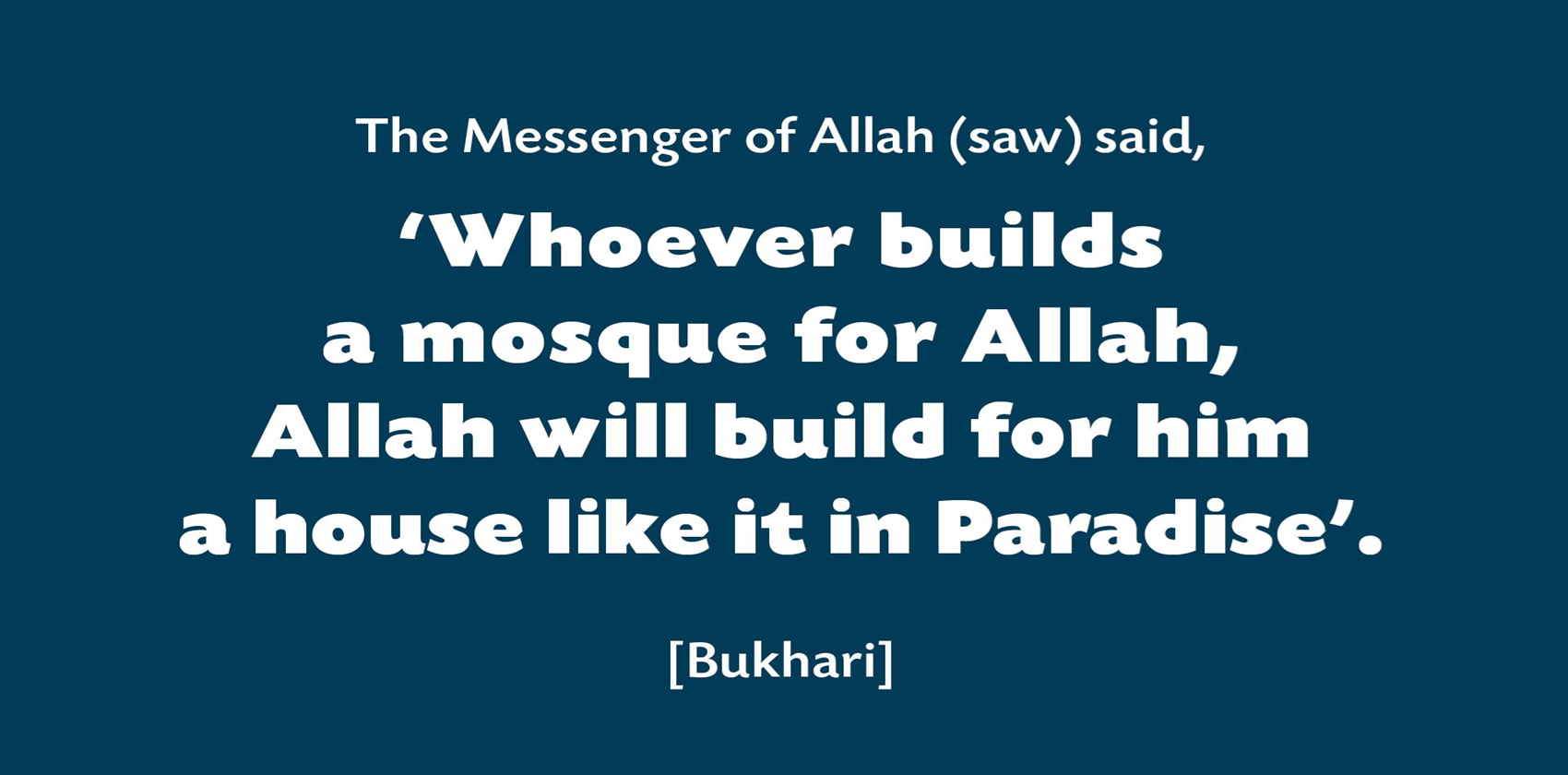

Raising £650,000 is a significant mountain to climb, but for a mosque expansion, you have a powerful advantage: a community that views this as Sadaqah Jariyah (continuous charity). To hit this target urgently, you’ll need a “multi-lane” strategy that combines quick wins with larger, structured contributions.

Just as the Langar of Shaykh Abdul Qadir Gilani (RA) never ran dry, let our support for the Masjid never falter.

We have reached a turning point. We are urgently raising £650,000 to complete the mosque expansion.

This is your chance to provide a "Continuous Charity" (Sadaqah Jariyah) that will benefit you and your family.

Milad-ul-Nabi is a time when the community gathers in large numbers to express their love for the Prophet (ﷺ).

Pay Your Donation Using The App

Proud to be serving hundreds of Muslims in Surrey

Meet Our Volunteers

Obligatory (Zakat) and voluntary (Sadaqah).

Got Questions?

Muslim: It is a religious duty specific to Muslims.

Adult & Sane: You must have reached puberty and be of sound mind (though some schools of thought suggest guardians should pay on behalf of children/orphans if they own significant wealth).

Complete Ownership: You must have full control over the wealth. Above the "Nisab": Your surplus wealth must be above a minimum threshold (Nisab) for one full lunar year (Hawl).

For 2026 (approximate values as of January):

Silver Nisab (612.36g): Usually around £400–£500.

Gold Nisab (87.48g): Usually around £4,500–£5,500.

Note: Most scholars recommend using the Silver Nisab because it sets a lower threshold, meaning more people qualify to pay, which ultimately provides more help to those in need.

Shares, stocks, and investment funds. Money owed to you (loans you've given that you expect to be repaid). Business stock/inventory. The Rate: You pay 2.5% of your total zakatable wealth.

Still Have Questions

Get on board, shall we?

Say Salaam